Image

Content sections

The project is part of the multi-country Fair Finance Asia programme (Vietnam, Cambodia, Philippines, Indonesia, Thailand, Japan, India, Pakistan)

The Fair Finance Vietnam

As a key driver of economic development, the financial sector produces a range of social and environmental impacts. In order to foster sustainable development, the project promotes environmental and social responsibility in financial institutions andgovernmental policies related to the banking sector.

Objectives

Long-term outcomes

- Improved regulations on the integration of ESG and HR criteria in the financial sector, along with improved policies and practices of national banks.

- Regional multi-stakeholder dialogue, including social organizations and allies, is initiated resulting in a joint multi-stakeholder roadmap and the conditions for a multi-stakeholder initiative (MSI).

Short-term outcomes

- Increased awareness and (political) will among national governments, regulators, banks and banking associations to adhere to ESG standards.

- Champions among national governments and banks interact with regional bodies and mutually influence each other.

- Regional bodies (governmental, social organizations, and financial sector networks), development banks, and investors are increasingly sensitive to policy requests from social organizations on the integration of HR and ESG criteria in loan and investment policies.

Image

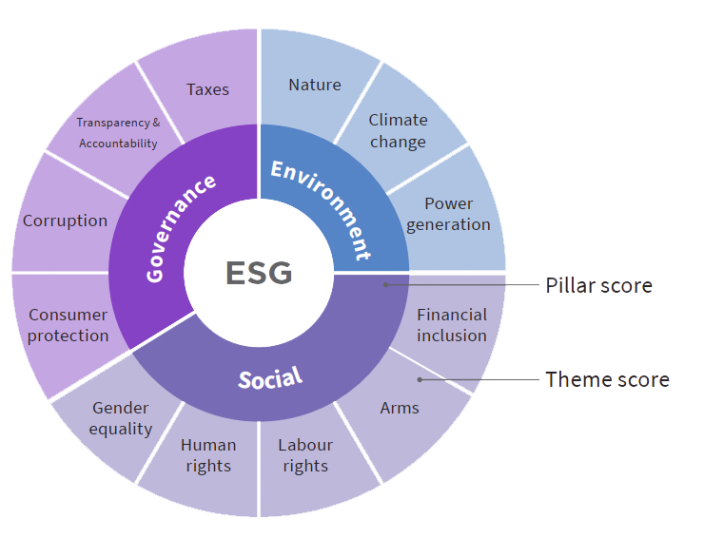

A sustainable financial sector in Vietnam with more transparent and accountable financial institutions that adhere to Environmental, Social and Governance (ESG) criteria.

Chart: ESG Themes under the Assessment in Vietnam

The project targets

- Social organizations that consider financial flows as vitally important for development processes in their specific and/or global context

- Financial institutions

- Financial regulators

- Investors

- Development banks

Locations

Thanh Hoa and Lao Cai provinces; then national level

Image