On September 12, 2025, the Vietnam Banking Academy held the launch ceremony of the Project “Promoting Green and Sustainable Finance in the Commercial Banking System” along with a thematic seminar of the same title.

In the opening remarks, Assoc. Prof. Dr. Pham Thi Hoang Anh, Deputy Director in charge of the Board of Management of the Vietnam Banking Academy, emphasized:

“The banking sector, as the lifeblood of the economy, not only performs the function of channeling capital but also bears the responsibility of directing capital flows toward green, clean, and environmentally friendly economic activities. Therefore, promoting green finance, green banking, and ESG practices is not merely a trend but an urgent task, contributing to the successful implementation of Vietnam’s Green Growth Strategy and its international commitments on climate change.”

The Project, supported by Oxfam, will contribute to the implementation of the National Green Growth Strategy through:

- Improving the effectiveness of environmental and social risk management in credit activities of commercial banks;

- Promoting green credit and ESG practices in commercial banks toward the goal of green and sustainable banking in Vietnam.

Nguyen Thu Huong, Senior Programme Manager - Governance, Oxfam in Vietnam, stated:

“This Project is a pioneering and meaningful initiative in the context where financial institutions and banks worldwide continue to announce and increase green capital sources and ESG-related investments. We believe the Project will make a positive contribution to the green transition of Vietnam’s banking and finance sector through research, training, and dialogue activities, enabling the sector to meet international ESG standards and enhance access to green credit sources.”

The Project will be implemented nationwide from 2025–2027, with a focus on commercial banks in Hanoi, Ho Chi Minh City, and other major urban centers.

The thematic seminar brought together representatives from the State Bank of Vietnam (SBV), commercial banks, experts from GIZ and FiinGroup, lecturers from the Vietnam Banking Academy, and researchers in the field of finance and banking.

Nguyen Trong Co, Deputy Director of the Bank-wide Risk Management Department at BIDV, emphasized that “integrating ESG into risk assessment is critically important in risk management—not merely in form, but in substance.” He also shared challenges faced by commercial banks:

“Funding sources for green credit are currently often short-term, while green credit projects require long-term investment. In addition, human resources in commercial banks for green credit assessment remain limited, leading to difficulties in appraisal.”

Nguyen Tuan Anh, MSc, from the Credit Department for Economic Sectors, State Bank of Vietnam, highly appreciated the Project’s activities and expressed his expectation that its outcomes would provide a basis for SBV’s policy decisions. He also noted that SBV will introduce appropriate policies to promote green credit outstanding. Currently, SBV is developing policies to support enterprises’ access to green credit and will soon seek public consultation.

Nguyen Thanh Hai, Senior Economic Expert at GIZ, shared insights into the process and importance of developing the Green Taxonomy, as well as plans for green finance and green credit training programs for the entire banking sector.

Hoang Dinh Minh, from the Forecasting, Statistics, and Monetary and Financial Stability Department of SBV, highly valued the relevance and urgency of the Project.

Presentations and discussions focused on solutions to bring green finance into practice, ranging from green credit mechanisms and environmental–social risk management to supporting enterprises in participating in the Net Zero roadmap.

Assoc. Prof. Dr. Pham Manh Hung, Deputy Director of the Institute for Banking Science Research, Vietnam Banking Academy, presented an overview of the Project.

Nguyen Nhat Minh, MSc, from the Institute for Banking Science Research, Vietnam Banking Academy, delivered a presentation on green credit and its practical implementation toward promoting green finance from the perspective of Vietnam’s banking sector.

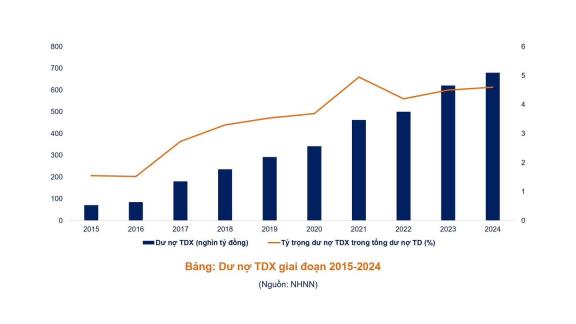

Green credit products are becoming increasingly diverse under various government programs. Green credit outstanding in Vietnam has shown clear improvement over the years, covering projects across diverse sectors. As of March 31, 2025, 58 credit institutions had recorded green credit outstanding totaling over VND 704.244 trillion, an increase of 3.57% compared to the end of 2024, accounting for 4.3% of total outstanding credit in the economy.

Green credit is understood as loans provided by banks for consumption needs, investment projects, and production–business activities that do not pose environmental risks, help protect the environment, and contribute to safeguarding the overall ecosystem.

In November 2025, the Project is expected to organize an ESG Forum for the Banking Sector to share experiences and best practices in ESG policies and initiatives, thereby contributing to strategic orientation for Vietnam’s banking industry.

Oxfam in Vietnam and Fair Finance Vietnam have published three reports assessing the level of ESG commitment among several commercial banks in Vietnam. This forms part of ongoing efforts to encourage commercial banks and financial institutions to apply ESG criteria in sustainable and responsible investment.